May round up: E.l.f Beauty acquires Rhode, why strategic diversification matters and how two-way dialogues are shaping the future of retail.

#67: This is In The Loop’s May round-up where you’ll find retail, fashion & beauty news and trends, through the lens of a retail strategist who loves to shop, share & dive in to all the latest.

What turns a browser in to a buyer? That’s the question on all of our lips.

Which strategies edge us closer to purchasing?

With every edition of In The Loop, I’ll be focused on answering this question, and breaking down the strategies and subtle tactics that brands and retailers are using to make us hit “buy”.

If you want a fascinating peek behind the retail scene, be sure to sign up for these monthly round ups and the weekly Retail Lab, where I deep-dive in to a specific retailer or a trend to show you the inner workings of the industry.

If you’re a shopper, it’s fun to know.

If you're a brand or a retailer, it’s must-know information for growing your business for tomorrow’s customer.

Here’s what’s coming up:

News Run Down - keeping you In The Loop, giving you everything you need and nothing you don’t

The Strategic Cues That Convert Shoppers Into Buyers - rounding up the best of of what I’ve seen in May

Trends for Today and Tomorrow - focusing on what works now while planning for the future

With that, let’s dive in.

News Run Down

Keeping you In The Loop, giving you everything you need, and nothing you don’t.

E.l.f. Buys Hailey Bieber’s Rhode Cosmetics Brand in $1 Billion Deal - The Washington Post

This is one of beauty’s most surprising acquisitions in a while. As demand for E.l.f products has slowed slightly, and the impact of tariffs comes in to effect, it makes sense for the business to diversify their brand offering, product selection and supply chain. Beauty moves fast and from a business standpoint this acquisition ticks all the strategic boxes to ensure E.l.f Beauty continues to thrive. Rhode is growing quickly and about to reach even more costumers as the Sephora UK and US launch edges closer, and with a higher price point, it allows E.l.f Beauty to dip in to luxury-leaning products that align with their core customer base.

Hermès, Chanel, Miu Miu lead with entertainment - Jing Daily

Luxury brands know customers expect much more than their high-quality and exclusive products can deliver; they want an end-to-end experience that money can’t buy, which is why we’re seeing a focus on emotional experiences that blend shopping with entertainment and creativity. In a world where almost any possession can be acquired by the ultra wealthy, experiences provide something money can’t buy and as consumers prioritise travel, entertainment and health over store-bought goods, it makes sense for their favoured brands to meet them where they are.

Can Nike reclaim its cultural credibility? - Jing Daily

Faced with fierce competition, Nike has been struggling to innovate and keep up with smaller more nimble brands, but can it catapult itself back to the fore of sport and culture? This is a fascinating read, not least because the sportswear market is all about innovation, and the longer Nike’s struggles continue, the harder it will be to catch up with competitors.

Superdrug bets on fashion with marketplace clothing expansion - Cosmetics Business

Beauty is struggling. As enthusiasts are overwhelmed with choice and rising prices (even E.l.f raised their prices by $1 per product last week), they’re becoming more selective with what they buy, proving that beauty is not the strong recession-proof category it was once painted to be. That’s why this move by Superdrug is fascinating- it signals that they know their customer wants value across fashion and beauty and they are catering to this need to increase spend and loyalty. I’m intrigued to see how well this lands, and how far Superdrug run with it.

Are we in the midst of a beauty brand identity crisis? - Cosmetics Business

Market saturation and customer fatigue are leading to an identity crisis. Brands need to innovate and they’re doing this by expanding in to adjacent categories. Is this the answer, and what’s the right way to do it? From a customer standpoint, beauty is more confusing than it has ever been. There has never been more product on a shelf, more advice on what we need to buy, or more pressure to purchase. So what’s missing? More brands selling effective products that do what they say they are going to do. In my experience, trying to do it all rarely works, and diversification of categories can lead to dilution of spend and messaging.

How Cannes became a strategic jewel in Chopard’s strategy - Vogue Business

High-end goods shine brightest when surrounded by ultimate luxury. Case in point: Chopard at Cannes. Since 1998, this tie up has been integral in showcasing the best of what the jeweller has to offer: quality, luxury, and glitz and glamour. If you want to know more, this take from Chopard is well worth a read.

Zara introduces a new “travel mode” feature in its mobile app - Fashion Network

Zara is always at the fore of blending physical and digital retail and their new travel mode feature seamlessly blends shopping and lifestyle, enabling customers to make purchases while exploring their surroundings. As we become more averse to direct marketing (ads are saturating social media and print magazines), we’re looking more for soft sells, products that fit seamlessly in to our lives, and what better way to capitalise on that than by blending shopping and lifestyle for the busy modern customer who is looking for ease and practical solutions? It’s about meeting the customer where they are, and that’s increasingly where they are having fun and experiencing life.

The Strategic Cues That Convert Shoppers Into Buyers

Let’s round up the best of what I’ve seen in May

Refy launched Refy World, a VIP shopping experience that feels like their Instagram “Group Chat” brought to life just in time for summer. With beauty buyers craving more than just products - think insider perks, freebies and exclusive updates - Refy is continuing to set new standards for customer engagement.

Jewellery personalisation is not new, but I’ve seen more brands encouraging this opportunity for creativity and co-creation. Astrid & Miyu, Pandora and Monica Vinader already offer personalisation, but the team at Edge of Ember have taken this a step further with the launch of Toi et Moi, offering the opportunity to create jewellery with a choice of gemstones. I also love Rani & Co and can’t wait to see their new collection of customisable charm bracelets launching next week.

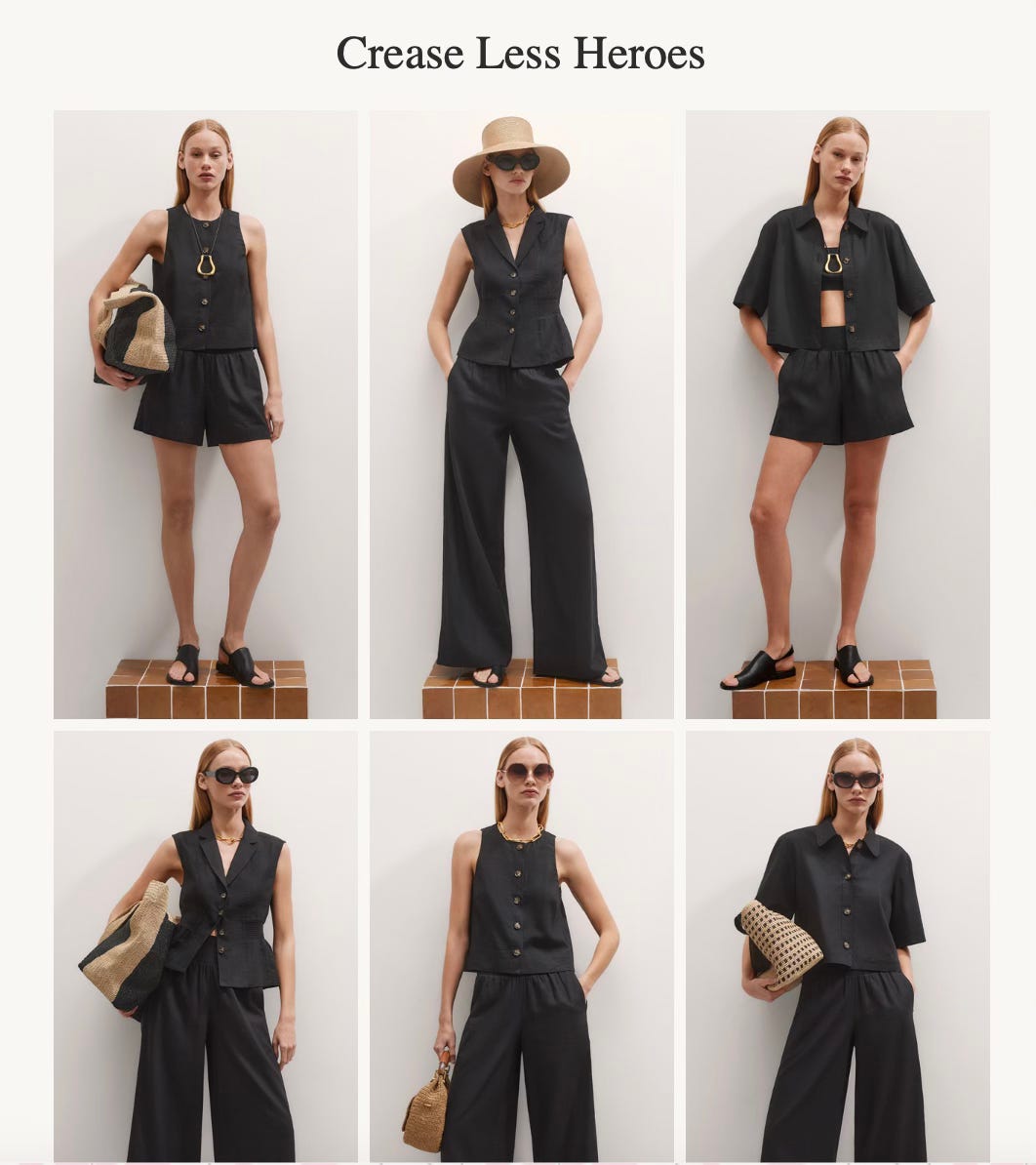

The latest Mango capsule collection is a lesson in accessible exclusivity- it’s luxurious and shows a growing trend towards brands offering tiered pricing to cater to customers’ diverse purchasing needs. Mango has recognised that their core customer is looking for occasional luxury alongside elevated basics, and it pays to create that offer to build brand trust and loyalty. Read more about their strategy here.

Travel beauty is big business. Customers are relaxed, suspending reality and time, and it’s the perfect time to shift their attention to purchasing. What used to be a time to kill time has now been transformed by fashion and beauty retailers in to a journey of discovery and purchase. Want more? This is a really interesting read about Morocconoil.

Beauty customers want more than a product and Dieux understands this perfectly. Their emails explaining pricing and ingredients create transparency, but now they’re using music to capture and sustain attention. Genius.

Collaborations are here to stay and the latest Anya Hindmarch x Uniqlo is a standout success, blending practicality with high-end fashion and adding a touch of fun. Blurring the lines between high-end and high street has been a win for brands for years, providing a visibility boost among a new audience, and for customers who get access to fresh products with an unexpected twist.

The launch of Merit’s Beauty Uniform SPF has been clever and strategic, much like everything they do. Teasing marketing campaigns encouraged email sign ups for a pre-sale ahead of the big launch and it created a sense of “get in there first” among the brand’s loyal customer base. Urgency sells, and beauty customers love being first in line.

As shoppers spend less time pouring over glossy magazines, brands like ME + EM and The White Company are turning their emails in to stylish, shoppable catalogues. It’s a smarter and more sustainable alternative to traditional print marketing, and perfectly blends shopping with the style advice customers need before making a thoughtful investment purchase. This approach is about nurturing a purchase, and that can take time.

Trends for today and tomorrow

Focusing on what works now while planning for the future

Occasionwear is back in a big but in a subtle way, catered for the modern customer who wants an elevated look minus the fuss. Looking good is no longer reserved for special occasions; shoppers want pieces that can take them from day to night with minimal tweaks and this is design challenge that savvy retailers like Mango and Mint Velvet are meeting head-on. It’s the perfect opportunity to create structurally complex, higher priced pieces from fabrics that non-luxury retailers would usually shy away from.

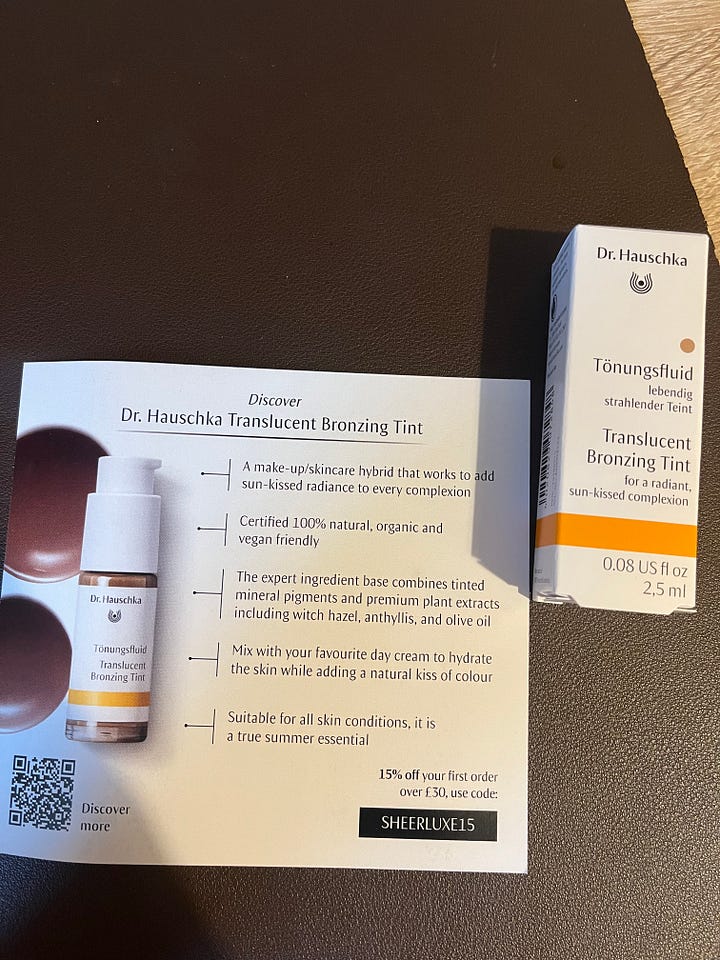

Product sampling, creating two-way conversations and building experiences are all part of the new experiential media strategy that is the future of retail. Innovation requires input and as brands find novel ways to reach new and existing customers, they’re trying everything from free samples to pop ups to increase engagement. The recent Dr Hauschka campaign with Sheerluxe is the perfect example of experiential media in action. This free sample coupled with background information on the Translucent Bronzing Tint and a QR code and discount for easy purchase is simple but unexpected and breaks us out of a rut (we’re creatures of habit when it comes to shopping) and opens up a new space for brands, purchases and experiences.

If you want to know more, this piece from WARC is well worth a read.

Back of House

I created In The Loop to take you inside retail’s persuasion game. Have you ever wondered how stores sell you more, without you even knowing it? Through my weekly musings, I uncover the fascinating tricks retailers use to get you to hit “buy”.

Shoppers, if there’s a retailer you’d like me to cover, hit reply to this email.

Retailers, if like what you see, I’d love to help you create a strategy that turns browsers into buyers.

Here’s how I can help:

Retail Strategy

I’m here to lend a hand whenever you could use some support.

With packages designed to suit you and your business, I can help you identify blocks and map out your strategy to give your business the edge.

Discover more at Retail Collaborative

Let’s stay in touch.

Reply to this email or connect with me on LinkedIn and Instagram.