Thursday round-up: Black Friday strategy, Glossier’s turnaround, and Ted Baker is back. Plus bookmarked articles & what I’ve loved.

#55: this is In The Loop, where you’ll find retail, fashion & beauty news and trends, through the lens of a retail strategist who loves to shop, share & dive in to all the latest.

Black Friday is here, and whatever you think of heavy discounting, you can’t escape the offers, price cuts, and deluge of marketing emails.

Sales are everywhere; as a shopper it’s chaos, as a retail strategist it’s the most interesting time of the year, even though I am reminded of just how many email lists I’m signed up to.

Are you feeling swamped?

I cut through the noise in this week’s newsletter, getting in to the best offers I’ve seen, and what I’d love brands to do to move beyond the sale; customers want more, and there’s a lot of untapped sales potential beyond slashing prices.

Here’s what I’m talking about this week:

Black Friday strategy

Glossier’s turnaround

Ted Baker is back online in the UK

Bookmarked - my quick take on news you don’t want to miss

Shopping notes - what I’ve loved this week

Black Friday strategy deep-dive

Black Friday offers started at the beginning of November with previews from brands capitalising on customers’ excitement for a month of discounts.

Here’s a list of strategies I’ve seen so far that are worth considering if you’re looking for inspiration or good value offers:

Flash sales can create daily urgency and encourage repeat visits/ browsing. Monica Vinader launch a new 24-hour flash sale every day for three weeks during November, and offer 30% off site wide.

Site wide discounts are very popular - spotted at Kiehls, Fresh, Sweaty Betty, Madewell, these offer great value if you’ve had your eye on a specific item, and are easy for retailers to manage.

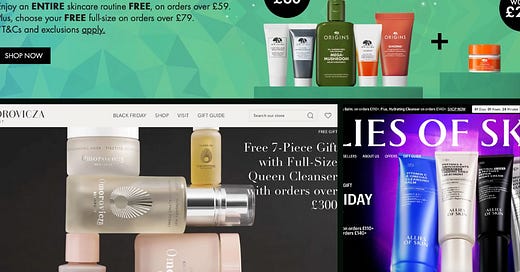

Gifts with purchase (GWP) have been popular again, especially in beauty. The best freebies I’ve seen this year can be found at Sephora, Omorovicza, Allies of Skin, and Origins, who always offer a great selection of minis to try (they’re also perfect for travel). These can be a great incentive if done right, and represent a good opportunity for retailers to clear excess stock.

Category-specific discounting is very popular this year, with Accessorize, John Lewis and Hobbs all offering discounts on popular seasonal categories like outerwear and scarves to drive sales. It has the added benefit of protecting margin in other areas, while still offering value for the customer.

Sneak peeks are one of the most common strategies we see, and they work, rewarding loyal customers and encouraging email sign ups. Strathberry got the messaging spot on with their email, highlighting the exclusivity of the offer and the quality of their pieces while offering a discount.

There is so much untapped potential around Black Friday messaging and offers. Here’s what I’d like to see:

Live events to drive sales of hero products and create buzz and forge personal connections

New launches coinciding with Black Friday are a great way to capitalise on the extra traffic that discounts are already generating

Social media challenges to boost engagement beyond Black Friday offers can build longer term relationships and provide a host of valuable data

Product bundles can increase basket size. Extra points if you can work out the logistics behind getting customers to create their own gift bag/ bundle from selected stock.

Friends talk and referral discounts can drive email sign ups and sales.

Partnerships are everywhere right now, but if you pick the right one, your brand could benefit from a whole new audience.

Gift cards at reduced prices could be a fantastic incentive for Black Friday for those who don’t know what to buy.

Spinning a virtual wheel is a simple way to increase engagement and get people talking because it adds the fun back in to shopping, while also giving a freebie or a discount.

Teasing member exclusives a few weeks before Black Friday offers can increase sign ups and reward loyalty.

Customers are savvy and they know sales aren’t only during Black Friday, so offer them exclusive items and experiences that they can only access during this period.

It's time to embrace Black Friday and be open to opportunities, so get creative!

Glossier’s turnaround strategy is turning heads

It’s been an eventful two years at Glossier. Having been lauded as one the of most successful direct-to-consumer companies, Glossier ran in to trouble. Now with a new CEO at the helm, tasked in 2022 with turning the business’ fortunes around, will Glossier disrupt beauty for a second time?

It seems so.

Under Kyle Leahy, the brand launched in Sephora in September 2023 and in wider international territories, opening it up to beauty obsessives who until then couldn't get their hands on products they had heard so much about. This pivot has helped to drive sales of almost $100m in Sephora alone because the pre-launch brand awareness was so high.

Beauty is an emotion and trend driven category which makes getting products in to customer hands as quickly and as easily as possible a priority.

Looked at this way, the DTC model was restrictive for both the beauty side of the business, and its ambitions to be a lifestyle brand. On a recent trip to the Covent Garden store, I saw the Glossier merch front and centre, signalling that the brand is selling more than just beauty, with candles, hoodies and bags all available to buy.

Expansion in to lifestyle is tricky and it requires listening to the customer. For an ordinary beauty brand, this could be a step too far, but for Glossier whose brand is rooted in the 00s blog culture, there’s a loyal community ready and waiting to listen (and buy).

If you want a deeper dive in to Glossier, listen to this podcast and make sure you’re subscribed to In The Loop because I’ll be talking about my recent store visit in Tuesday’s edition of Retail Lab.

Ted Baker relaunches in the UK- here’s my take

When Ted Baker collapsed earlier this year, as a customer, I was disappointed, but as a retail strategist, I was frustrated. For a brand with a cult following and loyal consumer base, it seemed ridiculous that they had reached this point. A serious of wrong decisions around inventory and stores ultimately cost Ted Baker.

Now they’re back online, trying to reach a large audience without the expense and logistical complications that come with physical stores.

First, Ted Baker does still have brand equity; customers haven’t forgotten them and the mid-market playful space they had in UK retail hasn't been filled. They represent quality and as we return to event dressing this is the perfect time for a relaunch.

But the same pitfalls need to be avoided.

Here are my thoughts on a future strategy:

The range needs to be diversified to move the brand away from its occasionwear destination label

Ted Baker needs to be rebranded for a younger customer

They need to go back to their roots and create quality pieces in vibrant prints that can be worn as everyday outfits

Customer feedback must be factored in to future ranges. Live shopping events could help to create a customer and product focused experience

Ted Baker sells great value beauty gift sets, but they could move in to this space with more full-size individual products

Homeware would be a great addition to Ted Baker; their prints are perfect for sprucing up living spaces

Further down the line, a pop-up store/ in-person event could generate buzz

Online international expansion needs to be carefully executed with the right location-specific product strategy

💫 I’m glad to see the return of Ted Baker. I think there’s so much potential for them with the right strategic direction.

🔖 Bookmarked

Anyone who knows me knows I love Sephora. I used to plan holidays around destinations that had a store, so to say I’m excited that the UK will have at least 20 stores in 2-3 years is an understatement. I think this is a great time for Sephora to expand in the UK. As a side note, I’d love to see them stock more French brands- Violette_FR would be a great addition.

What started off as an experiment has turned in to a huge deal during this Golden Quarter. TikTok shopping is the trend no retailer can afford to sleep on. This piece from the industry.fashion is well worth a read.

Next week, I’m deep-diving in to the trends I think are the future of retail, so this article from WWD caught my eye. Printemps is going to accept cryptocurrency for payment across 20 stores, as it looks to give customers more flexible payment options. Moving with the times might sound obvious, but there are few retailers who are innovating quite to boldly in the payment space.

💌 Shopping notes - things I’ve loved this week.

Jewellery personalisation always makes me smile because these investment pieces are often bought with sentiment and memories in mind, so what better way to make them more special than to add your own personal touch? I love the welded bracelets at Astrid & Miyu and the on-the-spot engraving at Monica Vinader.

Fortnum & Mason’s giant advent calendar is the stuff of dreams, and I can’t wait to see it myself

Photos of the new Dior Beauty store in NYC’s SoHo took my breath away. What an installation, and what a way to elevate the beauty shopping experience.

& Other Stories is relaunching beauty and making it fun again, and I’m here for it, especially as we head in to peak party season. The products are what beauty should be: affordable, colourful, and playful, and they feel like a breath of fresh. The range is linked here.

And that’s a wrap for this week!

I’d love to hear from you, so let me know what you think of this week’s edition and what else you would like to see over here on In The Loop.

Until next week,

Hina

→ What’s coming up next:

🧪 Retail Lab: Glossier’s new strategy IRL

🗞️ What does the future of retail look like? I talk about live events, curation, gift guides and the over saturation of collaborations.